If you are about to reach your golden years, retirement is looming. There are some who opt to delay retirement to work a bit longer because they don’t have enough funds saved up yet, while others have built a decent nest egg so they’re already planning what to do once they are officially out of work.

If you’re at that point when you are merely counting down the days before you are called a retiree, you might want to familiarize yourself with the top smart ways that you can spend your retirement fund. That’s exactly what we will find more about here.

Retirement-Related Statistics

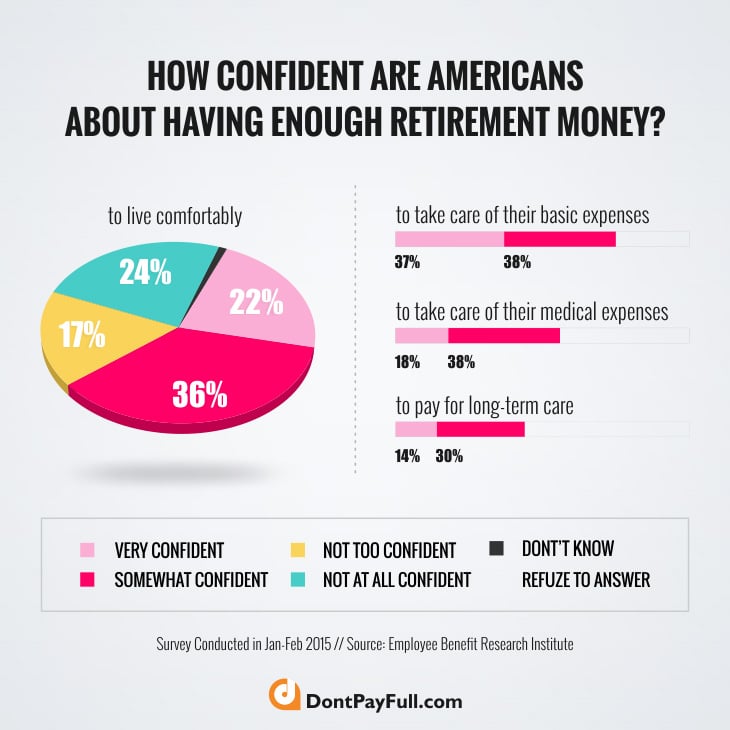

Before counting down the top ten things that you can do with your retirement money, let us first take a look at a few related statistics from Employee Benefit Research Institute:

In February 2015, here’s how confident survey respondents are that they will have enough money to life comfortably during retirement:

- 22% – Very confident;

- 36% – Somewhat confident;

- 17% – Not too confident;

- 24% – Not at all confident.

Saving for retirement is part of the personal finance industry, and saving by itself is defined as the act of preserving money for future use. Following the financial crisis in 2008, the personal savings rate in the US equalled 3%, doubling in the following years.

Aside from retirement, the goals of saving include taking a vacation, putting a down payment for a house or a car, paying for the kids’ college education, and starting a long-term investment. With almost half of retirees feeling very confident that they will have enough money to spend for their basic living expenses during retirement, it’s also a good idea to know how they can actually spend their retirement funds wisely.

Top 10 Tips on How to Spend Your Retirement Money Wisely

If you’re a fifty-something who is about to retire from the workforce or hand over the family business to its rightful heir, what are the ways for you to be wise when it comes to spending your retirement money? Take a look at our top ten tips:

1. Rely on the help of a financial advisor.

As technology advances and the quality of life improves, people are living much longer than they used to. A 60-year old woman may live to be eighty or even ninety. If she did not have enough funds saved up for the next twenty years, where will she get her daily living expenses?

Even if you are not that close to your retirement age, you should already have a financial plan in place for when you retire. Expect to live a very long, hopefully healthy life and never short change yourself.

The help of a financial advisor will come in handy so that he or she can give you a number of options on how to budget your money in case you get to live for the next twenty or so years after retirement. A financial advisor will also help you set short-term and long-term goals, and set out a plan on how you can reach them after retirement.

2. Consolidate your assets.

2. Consolidate your assets.

Next, consolidate your assets. As compared to retirees from past generations, the fiftysomethings of today have more diversified assets, jobs and careers. By consolidating your asset, you would have a solid idea about how much nest egg you actually have prior to retirement.

3. Use your retirement money to pay off your debts.

If you unfortunately belong to the percentage of the elderly population who is still indebted to credit card companies and other lenders, consider using a chunk of your retirement money to pay off your debts. From the remaining funds, you can craft a reasonable budget to live off of – without having to worry about creditors running after you.

4. Use the money to build an emergency fund.

One out of four Americans do not have an emergency fund set aside. While you were still working, you might have heard about the rule that you should have an emergency fund equal to six months’ worth of your living expenses. You can pretty much use the same rule for retirement, although you might want to extend the number of years.

5. Stick to a budget even if you are spending your retirement money.

Even if you have built a quite hefty nest egg for your retirement, it does not necessarily mean that you can spend money however you want. As mentioned earlier, people are living a lot longer these days so you should find a way to stretch your hard-earned dollars.

As a retiree, you should stick to a budget and determine which costs are fixed, and which expenses can be trimmed down. Knowing how much money you can spend each month will give you an idea if you are overspending or underspending. This way, you won’t have to worry about living off tasteless food for the next month if you happen to only rely on a small pension or a tiny retirement fund.

6. Limit the cash gifts that you are handing out to kids or grandkids.

One of the biggest misconceptions that retirees have is thinking that they can simply hand over cash gifts to their grandkids or kids however often they want. There is absolutely nothing wrong in spoiling your grandkids, but you should think of your own expenses as well.

Before offering to pay for your granddaughter’s summer camp expenses, check if you have the budget for it first. Depending on how much money you have, you can set aside an annual budget for cash or other gifts to your grandkids. Having such a limit will prevent you from overspending or running out of funds for living expenses.

7. Downsize your home to reduce your expenses.

7. Downsize your home to reduce your expenses.

Some elderly couples refuse to move out of the houses that their children grew up in because of the memories that they hold. Although you can always live in the same house that you’ve been for the past decades, you also need to consider the maintenance expenses.

If all the kids have moved out and there is just the two of you left in the house, consider how much you are spending on monthly utilities for maintaining such a big household.

To reduce your monthly living expenses, do consider downsizing your home. Do the same thing with your cars and other high-value properties that you have. If you’re an elderly couple who owns more than two cars, consider selling your other vehicles. Use the money for a vacation instead of letting its value just sit idly in the garage.

8. Set aside funds for the short-term, medium-term, and long-term growth.

After determining how much retirement money you have based on your assets, pension, and other post-retirement income sources, you can make a more solid plan on how to spend your retirement money. The first aspect of budgeting that you need to think about is the short-term, preferably for the next seven years.

Set aside this fund in an account which preferably earns 3%, and you can use it for immediate withdrawals.

The second aspect is for medium-term spending, which is anywhere from seven to fifteen years. This should earn 3% to 4% interest rate.

The third and final aspect is the guaranteed annuity, and you need to make sure that this is suitable for long-term growth. If you end up living a healthy, happy life for the next twenty or so years, you can do so without worrying about money for your everyday expenses.

9. Don’t make hasty financial decisions.

If you have your nest egg at your disposal, it is very tempting to buy fancy, expensive things or make hasty financial decisions without thinking about the consequences. Your justification could be that you worked hard for that money for more than half of your life. There’s no discounting this, and it is more the reason why you should steer clear of making any hasty financial decisions.

You wouldn’t want to spend your lifetime’s worth of earnings on some frivolous purchase that you will not be able to fully enjoy, anyway. Think twice about burning cash on unnecessary things, except for when they are experiences that you have always wanted to have since you were young – which leads us to the last item.

10. Set aside funds for something that you’ve always wanted to do.

10. Set aside funds for something that you’ve always wanted to do.

What better way is there to spend your retirement money than doing something that you’ve always wanted to do? While you were busy raising a family, you might not have had the time to go on a road trip to see the sights in the US. Do that during your retirement.

If you’ve always wanted to live near the beach in a tropical country somewhere in Asia, you can definitely do that as well. Just make sure that you have studied your finances before boarding the plane.

Retirement need not be a depressing thought. By being smart with how you spend your money, it can actually be one of the most exciting parts of your life because you will finally have the time – and the funds – to do what you have always wanted to do. Happy retirement planning!

2. Consolidate your assets.

2. Consolidate your assets. 7. Downsize your home to reduce your expenses.

7. Downsize your home to reduce your expenses. 10. Set aside funds for something that you’ve always wanted to do.

10. Set aside funds for something that you’ve always wanted to do.