5.00 out of 4 votes

When Is Tax-Free Weekend 2024? All 50 US States

Updated 17 min read

As the rush for back-to-school shopping kicks into high gear, there’s no better time to save than during the tax-free weekend. Parents, students, and savvy shoppers alike can significantly cut costs on essential items during this sale. Let’s explore everything you need to know about tax-free sales by state and how you can get more bang for your buck.

What Is Tax-Free Weekend?

Sometimes referred to as a sales tax holiday, it’s when sales tax is waived on specific items. This makes back-to-school shopping more affordable and encourages people to spend more. Eligible items are exempt from state sales tax, which cuts down the overall cost of purchases and helps customers buy what they need.

How Does Tax-Free Weekend Work?

Participating states temporarily suspend state sales tax on some categories of items. This means that when purchasing eligible goods in the designated state, the sales tax will be automatically waived at checkout without the need for additional paperwork or coupons.

Note that limits on item categories and price caps apply so that the benefits reach those who need them most.

How Long Is Tax-Free Weekend?

The duration of these sales tax holidays varies among states from a single weekend to an entire week. However, most tax-free sales are scheduled around the back-to-school shopping season in late July and early August.

When Is Tax-Free Weekend 2024?

Tax-Free Weekend Dates by State

⚠️

Attention: Below is a detailed table with the tax-free event dates for 2024 across all US states, along with eligible item categories and their maximum cost limits. States not included in this table aren’t taking part in the 2024 tax-free sale.

| State Name | Tax-Free Shopping Dates |

|---|---|

| Alabama | July 19-21, 2024 |

| Arkansas | Aug. 3-4, 2024 |

| Connecticut | Aug. 18-24, 2024 |

| Florida | July 29 – Aug. 11, 2024 |

| Iowa | Aug. 2-3, 2024 |

| Louisiana | Sept. 6-8, 2024 |

| Maryland | Aug. 11-17, 2024 |

| Massachusetts | Aug. 10-11, 2024 |

| Mississippi | July 26-27, 2024 |

| Missouri | Aug. 2-4, 2024 |

| Nevada | Oct. 25-27, 2024 |

| New Mexico | Aug. 2-4, 2024 |

| Ohio | Aug. 2-4, 2024 |

| Oklahoma | Aug. 2-4, 2024 |

| South Carolina | Aug. 2-4, 2024 |

| Tennessee | July 26-28, 2024 |

| Texas | Aug. 9-11, 2024 |

| Virginia | Aug. 2-4, 2024 |

| West Virginia | Aug. 2-5, 2024 |

Alabama

- Date: July 19-21, 2024

- What’s tax-free: clothing ($100 or less per item), computers ($750 or less), school supplies ($50 or less per item), and books ($30 or less per book).

- General tips: focus on clothing and electronics. Typical purchases include school uniforms, laptops, and textbooks.

- Extra info: For more details, check out Alabama no-tax weekend.

Arkansas

- Date: Aug. 3-4, 2024

- What’s tax-free: clothing and footwear ($100 or less per item); accessories ($50 or less per item); select electronic devices (no price limit); select school supplies (no price limit).

- General tips: take advantage of the no-limit on electronics to purchase laptops and tablets. Stock up on diapers and cosmetics, which are also tax-free.

- Extra info: For more details, check out Arkansas no-tax weekend.

Connecticut

- Date: Aug. 18-24, 2024

- What’s tax-free: clothing and footwear under $100 per item.

- General tips: this is an excellent time to refresh your wardrobe with tax-free apparel and shoes.

- Extra info: For more details, check out Connecticut no-tax weekend.

Florida

- Date: July 29 – Aug. 11, 2024

- What’s tax-free: clothing/footwear ($100 or less per item), school supplies ($50 or less per item), personal computers ($1,500 or less for non-commercial use).

- General tips: with an extended tax-free weekend, you can plan purchases around your paydays. Ideal for buying uniforms, laptops, and school supplies.

- Extra info: For more details, check out Florida no-tax weekend.

Iowa

- Date: Aug. 2-3, 2024

- What’s tax-free: clothing or footwear selling for less than $100 per item.

- General tips: prioritize essential back-to-school clothing items and take advantage of BOGO offers.

- Extra info: For more details, check out Iowa no-tax weekend.

Louisiana

- Date: Sep. 6-8, 2024

- What’s tax-free: hunting supplies, firearms, ammunition (no limit).

- General tips: it will be a great time to stock up on rifles, ammo, and other firearm supplies.

- Extra info: there are no further details about the 2024 Louisiana no-tax weekend, but you can check out more details about the 2023 tax-free event. This year will likely see similar conditions.

Maryland

- Date: Aug. 11-17, 2024

- What’s tax-free: clothing and footwear priced $100 or less per item; first $40 of a backpack or bookbag.

- General tips: this is a great time for families to shop for new school shoes and backpacks.

- Extra info: For more details, check out Maryland no-tax weekend.

Massachusetts

- Date: Aug. 10-11, 2024

- What’s tax-free: most retail items for personal use are priced at $2,500 or less, excluding certain categories such as motor vehicles and meals.

- General tips: high-value items like furniture, electronics, and appliances are smart buys.

- Extra info: For more details, check out Massachusetts no-tax weekend.

Mississippi

- Date: July 26-27, 2024

- What’s tax-free: clothing, footwear, and school supplies costing less than $100 per item. Firearms and hunting supplies will also be discounted towards the end of August.

- General tips: focus on clothing essentials and school supplies that fit under the price threshold.

- Extra info: For more details, check out Mississippi no-tax weekend.

Missouri

- Date: Aug. 2-4, 2024

- What’s tax-free: clothing ($100 or less per item), computers ($1,500 or less), school supplies ($50 or less per purchase).

- General tips: a great time to buy school uniforms and basic gadgets.

- Extra info: For more details, check out Missouri no-tax weekend.

Nevada

- Date: Oct. 25-27, 2024

- What’s tax-free: focused on personal property (no limit).

- General tips: unlike most other tax-free weekends, Nevada’s applies only to the National Guard.

- Extra info: For more details, check out Nevada no-tax weekend.

New Mexico

- Date: Aug. 2-4, 2024

- What’s tax-free: clothing or shoes priced at less than $100 per item; computers and tablets priced up to $1,000; related computer hardware up to $500; school supplies for under $30 per item.

- General tips: profit from savings on clothing and electronic devices for students.

- Extra info: For more details, check out New Mexico no-tax weekend.

Ohio

- Date: Aug. 2-4, 2024

- What’s tax-free: all tangible personal property worth $500 or less.

- General tips: this extended tax-free period is excellent for buying personal and school-related items.

- Extra info: For more details, check out Ohio no-tax weekend.

Oklahoma

- Date: Aug. 2-4, 2024

- What’s tax-free: clothing and footwear priced under $100.

- General tips: a tax-free weekend ideal for refreshing wardrobes with new shoes and outfits for the school year.

- Extra info: For more details, check out Oklahoma no-tax weekend.

South Carolina

- Date: Aug. 2-4, 2024

- What’s tax-free: clothing, accessories, footwear, school supplies, computers, software, and bed & bath supplies.

- General tips: with no dollar limits, this is the perfect time to buy many necessary items.

- Extra info: For more details, check out South Carolina no-tax weekend.

Tennessee

- Date: July 26-28, 2024

- What’s tax-free: clothing and school supplies ($100 or less per item), computers ($1,500 or less).

- General tips: focus on buying school uniforms and budget-friendly computers.

- Extra info: For more details, check out Tennessee no-tax weekend.

Texas

- Date: Aug. 9-11, 2024

- What’s tax-free: most clothing, footwear, school supplies, swimwear, and backpacks are priced at less than $100.

- General tips: stock up on back-to-school essentials and take advantage of online deals.

- Extra info: For more details, check out Texas no-tax weekend.

Virginia

- Date: Aug. 2-4, 2024

- What’s tax-free: school supplies ($20 or less per item), eligible clothing and footwear ($100 or less per item), and hurricane-preparedness items ($60).

- General tips: consider buying hurricane preparedness items like generators and batteries besides school supplies.

- Extra info: For more details, check out Virginia no-tax weekend.

West Virginia

- Date: Aug. 2-5, 2024

- What’s tax-free: clothing ($125 or less per item), school supplies ($50 or less), school instruction material ($20 or less), laptops/tablets ($500 or less), sports equipment ($150 or less).

- General tips: this is a versatile list, making it easy to cover all school-related purchases.

- Extra info: For more details, check out West Virginia no-tax weekend.

States Not Participating in the Tax-Free Weekend 2024

| Alaska* | Nebraska |

| Arizona | New Hampshire |

| California | New Jersey |

| Colorado | New York |

| Delaware | North Carolina |

| Georgia | North Dakota |

| Hawaii | Oregon |

| Idaho | Pennsylvania |

| Illinois | Rhode Island |

| Indiana | South Dakota |

| Kansas | Utah |

| Kentucky | Vermont |

| Maine | Washington |

| Michigan | Wisconsin |

| Minnesota | Wyoming |

| Montana |

15 Popular Stores to Buy from during Tax-Free Weekend

| Store | Popular Tax-Free Products |

|---|---|

| Walmart | Laptops, clothing, school supplies |

| Target | Tablets, kid’s clothing, dorm essentials |

| Amazon | Echo Devices, laptops, school supplies |

| Best Buy | Laptops and desktops, smartphones, headphones |

| Macy’s | Clothing, home goods, footwear |

| Kohl’s | Activewear, kitchen appliances, school uniforms |

| Office Depot | Printers, backpacks, desk chairs |

| Staples | Binders and notebooks, laptops, writing supplies |

| Old Navy | Jeans, graphic tees, outerwear |

| Gap | Sweaters, khakis, denim jackets |

| JCPenney | Bedding sets, school uniforms, smartwatches |

| Apple | MacBooks, iPads, AirPods |

| Dell | XPS laptops, Inspiron laptops, monitors |

| HP | Spectre laptops, DeskJet printers, OMEN gaming PCs |

| Nike | Running shoes, athletic apparel, backpacks |

1. Walmart

Walmart offers everything from clothing and electronics to school supplies. Families go to Walmart for tax-free savings on big-ticket items and everyday essentials. With many locations nationwide and a great online shopping platform, Walmart lets you bag your bargains without battling crowds.

Popular Products

- Laptops: ideal for students needing a tech upgrade for the new school year.

- Clothing: affordable options for back-to-school outfits, including uniforms and casual wear.

- School supplies: notebooks, backpacks, and writing utensils.

💡

Tip: Planning to shop at Walmart? Get extra savings with Walmart coupon codes.

2. Target

Shoppers often praise Target for its trendy clothing, quality electronics, and great school supplies section. The store’s layout and simple navigation make it a pleasant shopping experience during and outside the tax-free weekend. With Target Circle and RedCard benefits, you can save even more on your purchases.

Popular Products

- Tablets: from iPads to budget-friendly Androids, Target has options perfect for both education and entertainment.

- Kids’ clothing: stylish and durable options for everyday schoolwear.

- Dorm essentials: bedding, storage solutions, and small appliances for college students.

💡

Tip: Planning to shop at Target? Get extra savings with Target coupon codes.

3. Amazon

The online giant offers everything from high-end electronics to basic school supplies, all with the added convenience of Prime shipping for members. Amazon frequently runs special promotions and discounts that coincide with tax-free weekends, so you could get even higher savings.

Popular Products

- Amazon Echo Devices: smart speakers and displays to improve home connectivity and learning.

- Laptops: many brands and price points to suit different needs and budgets.

- School supplies: bulk packs of pens, pencils, and notebooks to last the entire school year.

💡

Tip: Planning to shop at Amazon? Get extra savings with Amazon coupon codes.

4. Best Buy

During tax-free sales, Best Buy offers lower prices for computers, tablets, and other electronic devices. Their price match guarantee helps you get the best deal possible. The Geek Squad is available to assist with setup or any technical issues you might encounter online and in-store, simplifying your shopping experience.

Popular Products

- Laptops and desktops: from gaming rigs to student laptops.

- Smartphones: the latest models from top brands like Apple and Samsung.

- Headphones: noise-canceling options, perfect for focused study sessions.

💡

Tip: Planning to shop at Best Buy? Get extra savings with Best Buy coupon codes.

5. Macy’s

Macy’s blends luxury and affordability, making it a popular stop for tax-free weekend shoppers. With many clothing products and home goods, Macy’s features high-quality brands and designer labels. Their frequent sales and promotions, coupled with tax-free savings, make it easier to snag premium items at a fraction of the cost.

Popular Products

- Clothing: designer jeans, dresses, and business-casual outfits.

- Home goods: stylish bedding, kitchenware, and bath accessories.

- Footwear: various shoes from athletic to formal wear.

💡

Tip: Planning to shop at Macy’s? Get extra savings with Macy’s coupon codes.

6. Kohl’s

Kohl’s is loved for its generous discounts and Kohl’s Cash rewards program, which provides great savings, especially during tax-free weekends. From clothing and accessories to home essentials, Kohl’s product range is available at competitive prices. Their frequent promotions and clearance sections are a treasure trove for budget-conscious shoppers like you.

Popular Products

- Activewear: durable and trendy options for both adults and kids.

- Kitchen appliances: small appliances like coffee makers and blenders.

- School uniforms: affordable and durable options for every grade level.

💡

Tip: Planning to shop at Kohl’s? Get extra savings with Kohl’s coupon codes.

7. Office Depot

Stop at Office Depot for school and office supplies during tax-free events. The products cater to students and professionals alike, with the store helping you get well-equipped for the school year or your company office. Office Depot’s frequent sales and bulk purchase options make stocking up more affordable.

Popular Products

- Printers: reliable models perfect for home and professional use.

- Backpacks: durable options with plenty of compartments for school essentials.

- Desk chairs: ergonomic options to support good posture during study sessions.

💡

Tip: Planning to shop at Office Depot? Get extra savings with Office Depot coupon codes.

8. Staples

Staples is synonymous with office and school supplies, making it a hot spot during tax-free weekends. Known for diverse and quality-first products, Staples helps you find everything you need to start the school year off right. Their rewards program and frequent promotions add up to even more savings.

Popular Products

- Binders and notebooks: items for organizing schoolwork.

- Laptops: a selection of educational and high-performance models.

- Writing supplies: pens, pencils, and highlighters in various styles and colors.

💡

Tip: Planning to shop at Staples? Get extra savings with Staples coupon codes.

9. Old Navy

Old Navy is a favorite for fashionable yet affordable clothing, especially during tax-free weekends. With trendy styles in many sizes, Old Navy is a one-stop shop for back-to-school fashion. Their frequent sales and promotions make it easy to stock up on clothing essentials without breaking the bank.

Popular Products

- Jeans: durable and stylish options for everyday wear.

- Graphic tees: trendy and comfortable for casual days.

- Outerwear: jackets and hoodies to get ready for the cooler months.

💡

Tip: Planning to shop at Old Navy? Get extra savings with Old Navy coupon codes.

10. Gap

Gap offers classic, high-quality clothing that stands the test of time, making it a staple for tax-free shopping. With durable fabrics and timeless styles, Gap is perfect for anyone investing in versatile wardrobe pieces. The store’s seasonal sales further improve the value of your purchases.

Popular Products

- Sweaters: cozy and stylish options for fall and winter.

- Khakis: comfortable and versatile for both school and casual wear.

- Denim jackets: a classic piece suitable for various outfits.

💡

Tip: Planning to shop at Gap? Get extra savings with Gap coupon codes.

11. JCPenney

JCPenney’s balanced mix of affordability and quality makes it a popular choice during tax-free weekends. The store features many products, including clothing, home goods, and electronics. Frequent sales and possibly earning JCPenney Rewards improve the shopping experience with extra savings.

Popular Products

- Bedding sets: comfortable and stylish options for dorm rooms.

- School uniforms: budget-friendly and durable choices for students.

- Smartwatches: tech-savvy accessories to help keep track of schedules.

💡

Tip: Planning to shop at JCPenney? Get extra savings with JCPenney coupon codes.

12. Apple

The Apple Store has many gadgets that tech enthusiasts might want. Apple offers many premium electronics, including devices perfect for students and professionals alike. The Back to School promotion often coincides with tax-free shopping, providing even more incentive to upgrade your smartphone, laptop, tablet, or other gadgets.

Popular Products

- MacBooks: high-performance laptops ideal for students and creative professionals.

- iPads: versatile tablets for note-taking, reading, and entertainment.

- AirPods: wireless earbuds perfect for studying and commuting.

💡

Tip: Planning to shop at Apple? Get extra savings with Apple coupon codes.

13. Dell

Dell’s reliable and powerful computers make it a top choice during tax-free weekends. Their laptops and desktops cater to different needs, from basic schoolwork to high-end gaming and professional use. Dell frequently offers promotions that align with tax-free sales, creating extra savings.

Popular Products

- XPS laptops: high-performance models for demanding tasks.

- Inspiron laptops: budget-friendly options for everyday use.

- Monitors: high-resolution displays for better productivity.

💡

Tip: Planning to shop at Dell? Get extra savings with Dell coupon codes.

14. HP

HP is trusted for both personal and professional computing needs, and their products become even more attractive during tax-free sales. With laptops, desktops, and printers, HP helps you get the tech you need for the upcoming school year or your professional requirements. Their frequent sales pair well with tax-free savings.

Popular Products

- HP Spectre laptops: sleek and powerful laptops for multitasking.

- DeskJet printers: affordable and efficient printing solutions.

- OMEN gaming PCs: high-performance computers for gaming and graphic design.

💡

Tip: Planning to shop at HP? Get extra savings with HP coupon codes.

15. Nike

Nike is a top choice for athletic wear and footwear, especially during the tax-free weekend. With its quality and innovative designs, Nike offers products catering to athletes and casual wearers. Sales events often coincide with tax-free events, providing extra discounts on products with reduced items.

Popular Products

- Running shoes: durable and comfortable options for various sports.

- Athletic apparel: high-performance wear for training and everyday use.

- Backpacks: stylish and functional, perfect for school and sports.

💡

Tip: Planning to shop at Nike? Get extra savings with Nike coupon codes.

10 Shopping Tips for Tax-Free Weekend

- Make a shopping list: focus on essential items to avoid unnecessary spending.

- Know your state’s rules: check your state’s specific guidelines for eligible items and price restrictions.

- Shop early: beat the rush to ensure you get the best selection of items.

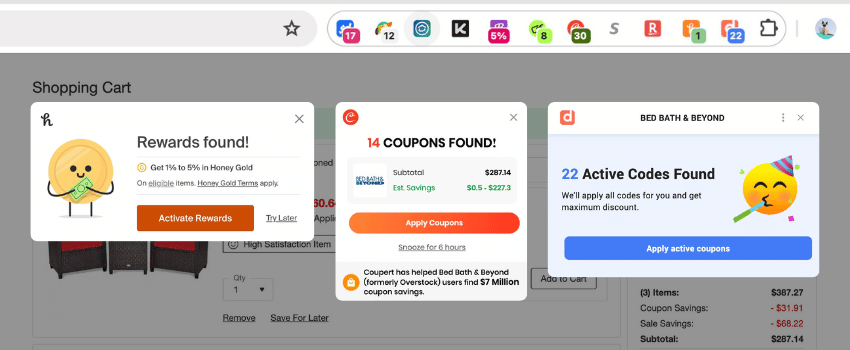

- Use coupons: apply store coupons and promo codes to increase your savings.

- Check online deals: many online retailers participate in tax-free shopping.

- Understand return policies: understand the return policies for items bought during tax-free sales.

- Budget for big-ticket items: prioritise high-value items like electronics to save more.

- Shop multiple stores: compare prices across different retailers for the best deals.

- Look for BOGO offers: take advantage of buy-one-get-one deals to stretch your budget.

- Consider layaway options: some states allow tax-free savings on layaway items as long as they are paid off during the tax-free period.

Tax-Free Weekend FAQs

Are Tax-Free Sales Online?

Yes! In all states offering tax-free shopping, you can buy online and not pay sales tax during those states’ sales tax holidays. However, your shipping address must be within the participating state.

Can I Shop from Other States If I’m Not a Resident?

Yes, you can shop in a state offering tax-free prices even if you’re not a resident. Just make sure your purchases are delivered to an address within that state.

Do Local Taxes Still Apply?

Local taxes may still apply in some states even if the state sales tax is waived. Check your state’s specific regulations for details.

Can I Use Coupons during Tax-Free Weekend?

Absolutely! Using store coupons and promo codes will further reduce the price of eligible items, helping you get extra savings.

What Happens If I Return an Item?

Return policies vary by retailer. Generally, if you return an item bought during the tax-free event, the refund will include the waived tax.

Are Layaway Purchases Eligible?

In some states, items placed on layaway during tax-free shopping are eligible for the sales tax exemption, provided they are paid off during the designated period.

When Is the 2024 Tax-Free Weekend in My State?

Each state has its own dates for the event. Check this table for the full rundown.

Do You Have Any Suggestions?

We're always looking for ways to enrich our content on DontPayFull.com. If you have a valuable resource or other suggestion that could enhance our existing content, we would love to hear from you.

Was this content helpful to you?